And the Award Goes To ...

Trulaske faculty win best paper awards at some of the most prominent business conferences and competitions.

By Kelsey Allen

What do the Trulaske College of Business, Harvard Business School and the Kellogg School of Management have in common? Their research faculty produce papers that earn best paper awards at some of the most prominent business conferences and competitions.

From developing new machine learning classification methods in order to predict future return states to analyzing the most effective sales agent tactics over internet-enabled live-chat portals, MU faculty are leading the way in accountancy, marketing, management and finance research.

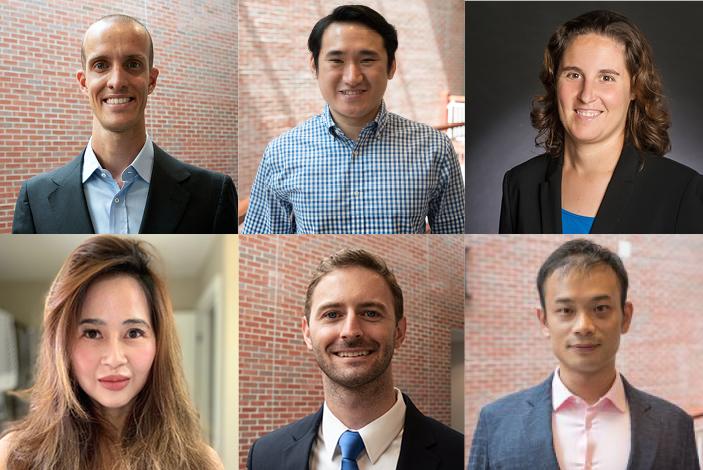

Here’s a look at five Trulaske professors whose research projects resulted in best paper awards in the past two years.

Dear Larry, Your Letter Works

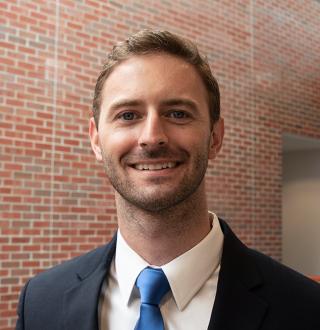

In 2012, BlackRock CEO Larry Fink started an annual tradition of penning a letter to the CEOs of his firm’s portfolio companies and publishing it on his investment management company’s website. These “Dear CEO” letters highlight issues from capital management and long-term strategy to climate change and workforce disparities, and they’re eagerly anticipated and closely watched by companies and investors — and Andrea Pawliczek, an assistant professor of accountancy and the BKD Faculty Scholar in the Trulaske College of Business.

“BlackRock is the largest asset manager — they have somewhere in the neighborhood of $7 trillion in assets that they’re managing — so anything Larry Fink says is going to get attention,” Pawliczek says.

But does this attention translate to influence? Pawliczek and her colleagues at the University of Georgia and Pennsylvania State University found it does.

In a paper titled “A New Take of Voice: The Influence of BlackRock’s ‘Dear CEO’ Letters” — which won the Best Paper Award at the 2020 Review of Accounting Studies Conference — the researchers show that 30 days after a letter was published, firms with significant BlackRock ownership filed 8-K disclosures that contained language more similar to what Fink included in his letter than firms with less BlackRock ownership. (An 8-K is a broad form used to notify investors of any significant event; significant ownership was defined in the study as at least 5% of the firm’s outstanding shares.)

For example, after Fink called firms to acknowledge and quantify the environmental impact of business and advocate for public policies such as environmental regulation, a firm might disclose in its earnings announcement how it is going to measure its carbon emissions. “So instead of just saying, ‘This is how much we earned,’ they may say, ‘In our plans for next year, one of our goals is to reduce carbon emissions by X amount,’” Pawliczek says. “So it can actually signify that the firm is changing its actions.”

Or at least the firm intends to change its actions. The researchers only found some evidence that portfolio firms alter their lobbying activities to align with the policies advocated for in the letters. And the effect is stronger for firms that were more likely to already have their policy agenda aligned with BlackRock’s.

Regardless, BlackRock takes notice: The researchers found that BlackRock rewards firms that make disclosures that mirror the topics in the “Dear CEO” letter with less opposition to management on shareholder proposals. “The firms that are talking more about the issues BlackRock is talking about are less likely to have BlackRock vote against firm management at the next annual meeting,” Pawliczek says.

This research shows that broad-based public engagement like the “Dear CEO” letter — as opposed to more costly private interactions — can be a cost-effective way for institutional owners to communicate recommendations to and mobilize firms. “It broadens how investors think about how they’re interacting with firms,” Pawliczek says. “This opens up another avenue.”

How to Sell Online with Live Chat

When a consumer is shopping online and has a question, there’s a good chance they turn to the retailer’s live chat support team. However, that’s not the only way customers use live chat. An increasing number of people are negotiating and asking for price discounts online.

Yet little is known about how to effectively close sales on this text-based platform, says Frank (Yufan) Lin, an expert in the live-chat selling area and a marketing PhD candidate in the Trulaske College of Business. In face-to-face settings, a salesperson can gain a customer’s trust by dressing professionally, shaking their hand and making small talk, for example. “But on live chat, they cannot do any of that, so it’s very difficult for them to close the sale,” Lin says.

To determine what sales strategies are effective in closing sales in online live chats, Lin analyzed 10 months of live-chat transcripts in which customers attempted to bargain with a sales agent for a Fortune 500 national home appliance retailer. In his paper, “Letting Customers Win: Live-Chat Agent Effectiveness in B2C Sales Negotiations” — which won the American Marketing Association’s 2021 Sales Special Interest Group Doctoral Dissertation Proposal Competition — Lin identifies three sales agent tactics that affect the sales closing likelihood: deliver, delay and affirm.

When a salesperson delivered an unadvertised discount, it increased the sales closing likelihood by 10%. “But more important is how to give a discount,” Lin says. Rather than giving the discount right away, if the sales agent delayed the delivery of the discount for few minutes — by saying, “Let me talk to my manager and see the best I could do,” or “Let me check my resources to see what would be the best I could do for you,” Lin offers as examples — it increased the sales closing likelihood by 20%.

But when the sales agent attempted to affirm the product’s value, it had the opposite effect, reducing the likelihood of closing the sale by 18%. “The use of value affirmation is counterproductive,” Lin says.

That’s because the live-chat arena activates a scarcity mindset in the customer, which changes the way their brain processes information. “Live chat empowers the consumer to seek better deals online,” Lin says. “But they also have the uncertainty of getting the discount. The next salesperson from either the same or another retailer may not give you the same discount, so you have to make decisions during the live chat.” The uncertainty of opportunity and urgency to make the decision creates a scarcity mindset in the live-chat bargaining consumers’ minds.

This urgency and uncertainty — which is amplified if the sales agent delays the delivery of the discount — encourages the customer to take the discount when it is eventually offered. On the other hand, affirming the many benefits of the product overwhelms the customer.

“Under the scarcity mindset, the consumer doesn’t have the cognitive capability to do a more thorough evaluation, so they’re more likely to delay their purchase and think more about it and do more research, which reduces the closing likelihood,” Lin says.

In addition to conducting the first formal research showing that live chat is an effective sales closing platform, Lin is also developing a dictionary to allow cue-based training and technology-assisted selling with dynamic script suggestions so that, in the future, live-chat salespeople can be prompted with those cues when dealing with a bargaining consumer.

A Big Data Approach to Stock Market Predictions

Kuntara Pukthuanthong is changing the way investors predict stock returns. A professor of finance in the Trulaske College of Business, Pukthuanthong and Yang Bai, a PhD candidate in the Finance Department, developed a new machine learning classification method that generates information about future return states from the interpretation of historical observations.

“The way the financial market works has changed,” Pukthuanthong says. “This is the era of big data. We don’t think the conventional methodology works that well. We want to apply a new approach that can be the future of financial markets.”

Currently, most finance literature focuses on the numeric predictions of stock returns. Next year, Apple will generate 50%, for example. “But that doesn’t give you anything,” Pukthuanthong says. “Even if you know that Apple gives you 50%, how about Tesla? How about Microsoft? You don’t have a sense of which one will be at the top or which one will be at the bottom.”

Plus, numeric value predictions “cannot directly reflect the conditional uncertainty of the potential outcomes” and they “can only evaluate the prediction quality with error-based metrics,” Pukthuanthong and Bai write in their paper, “Machine Learning Classification Methods and Portfolio Allocation: An Examination of Market Efficiency.”

Instead, the authors frame the asset pricing problem as a machine learning classification problem. Using historical information and applying machine learning — “Which means we used a lot of data in order to see the predictability of the predictor that we’re interested in,” Pukthuanthong says — they were able to learn which predictor is the best predictor of stock return using in-sample predictability and testing it against out-of-sample predictability. (An in-sample forecast uses all available data in the sample to estimate a model. An out-of-sample forecast instead uses a subset of the available data to forecast values outside of the estimation period.)

Testing the accuracy of 3.34 million return state predictions, the researchers show that individual stocks with higher trading friction — such as illiquidity, noise from the stock return, stock trade transaction fees — acquire higher expected returns. Then they “bucketize” the stock returns and split them into 10 return states. “So instead of predicting the absolute number, we give investors the classification into each group,” Pukthuanthong says. “Why? We show that firms that are in the extreme deciles tend to have a higher probability of moving to another decile. So what an investor should do is buy the stocks that are in the top and then sell the stocks or do short selling on the stocks at the bottom. They can do a long-short strategy.”

Their research shows that these prediction-based portfolios beat the market with significant out-of-sample economic gains — and their paper placed third place in the 19th annual Dr. Richard A. Crowell Memorial Prize competition sponsored by PanAgora Asset Management. The competition is widely known for recognizing leading academic research in asset pricing that connects theory with industry practice.

“When your work is valued by not only academics but also practitioners, that is the best in my opinion,” Pukthuanthong says. “It has to be applicable.”

Three-dimensional Competition

Stephen Downing, an assistant professor in the Management Department at the Trulaske College of Business, studies how organizations understand and engage with their competitive environment — and he noticed an inconsistency.

One school of thought from economics recommends advantage-seeking actions. “It says you’re going to try to stake out your position, and it’s going to be beneficial for you when you get that good position, so you’re going to want to keep it,” Downing says. If a firm were playing chess, the chessboard would influence how the firm moves in order to gain an advantage. For example, retail banks, automotive and pharmaceutical manufacturers, and airlines might compete by reducing prices or implementing marketing initiatives. “They are seeking just to try to gain the better customer share in their current market. Once firms get into that position where they’re a little bit buffered from competition, then they can reduce how intensely they compete.” Structure influences conduct.

Another school prioritizes opportunity-seeking actions. “This is where firms will try to change the structure of the markets that they’re in and who they compete with,” says Downing, offering Facebook’s acquisition of Oculus and Amazon’s of Whole Foods as examples. In this chess match, the firm takes an action that actually changes the shape or arrangement of the chessboard to its benefit. “You don’t try to just stake out a position that’s buffered against competition. Instead, you try to jump into the fray and get there first or copy whoever was there first better to jump ahead of them.” Conduct reshapes structure.

What Downing and his colleagues wanted to know is: What do firms that compete in multiple markets do? “They are given conflicting prescriptions from these two different schools of thought — that they should reduce their rivalry because they can save cost or that they need to go out and find new opportunities to create and capture value,” he says. To answer their question, the researchers looked at 74 multimarket contact tech firms with seven years of data and wrote a custom program that measured processing changes from opportunity-seeking actions and competitive behavior measures from advantage-seeking actions.

In their paper, “Competitive Dynamics of Interindustry Systems: How Structure and Conduct Coevolve, the authors show not only that firms should do both but also that, in the process of doing both, one type of action affects the other — a concept they termed “competitive ambidexterity.”

Downing explains: “It’s not like in every industry you can just say you’re going to secure your position and then defend it because it’s profitable for you there. No, there’s too much change happening for that to be securable. Also, firms can’t only go for creating and seeking new opportunities because they also have to be able to extract some value for their investors. They have to be able to balance these competing aims so that they can grow as much as possible. They can use those opportunity-seeking actions to move into positions where they’re actually less likely to face aggressive advantage-seeking. So it’s not just structure of multimarket overlap that influences action; it’s also action that changes structure.”

Essentially, they coevolve. The implication for managers, Downing says, is that they’re “playing on a moving chessboard and some of their actions are actually responsible for changing that chessboard. Because firms can do both — play on the current board and change the board — they have to recognize these types of actions are interdependent and try to balance both to get the best of both worlds.” As for the researchers, their paper won Best Paper Proceedings — the top 10% of accepted papers — at the 2020 Academy of Management Annual Meeting, STR Division.

Investing in Human Capital

To Matteo Binfarè, it’s a good sign that the University of Missouri System puts a chief investment officer in charge of its endowment. An assistant professor in the Finance Department at the Trulaske College of Business, Binfarè recently won an award for his research that shows university endowments directly benefit from having access to experts in alternative investments.

“Putting your $2 billion endowment into a passive 60/40 portfolio isn’t a suitable strategy going forward,” says Binfarè, whose co-authored paper, “How do Financial Expertise and Networks Affect Investing? Evidence from the Governance of University Endowments,” won the Two Sigma Award for the Best Paper in Investment Management at the 2019 Western Finance Association Meetings. “You need to take more active risks.”

In a study of over 11,000 board members for 579 endowments, Binfarè and his colleagues found that universities that have financially savvy board members and an extensive network of investment professionals — such as a CIO, an investment committee and alumni with investment knowledge — are more likely to invest significantly more in alternative investments, such as private equity, hedge funds and venture capital. Therefore, they have the opportunity to earn higher returns.

“Alternative investments are usually very hard to grasp and understand,” says Binfarè, comparing them to traded public securities. “They require knowledge and sophistication.” Although private assets require an additional layer of intermediation (thus fees), they are also illiquid investments, so they usually pay a premium on top of their returns — or an illiquidity premium. Because endowments are basically long-term savings accounts, they can bear the illiquidity risk and get higher risk-adjusted returns.

The researchers also find that the level of human capital is also associated with higher net returns, Sharpe ratios and “selection” returns in alternative assets. “Think about Yale, Brown,” Binfarè says. “Those endowments are able to access very high-performing investments because of their connections. They know the hot manager in venture capital, so they are able to access better investments.” The importance of human capital emerges even after controlling for endowment size and is particularly notable in private markets.

“What we find is that even when you account for fees, those endowments that have a better system, better governance and more sophisticated investment teams, they perform better even after the fees that they pay,” Binfarè says. “You cannot just leave your endowments in the hands of a board that doesn’t have the time to manage that portfolio. You need specialized investment professionals. Having those people inside managing the endowment is much more beneficial and can get you higher returns as well as lower risk.”