Research Spotlight: Accounting Insights from the Trulaske College of Business

By Kevin Reape

The faculty of the Trulaske College of Business School of Accountancy are at the forefront of addressing some of the most pressing concerns in contemporary accounting. Their most recent explorations span a gamut of topics, from dissecting the nuanced dynamics between client importance and unconditional conservatism in intricate accounting estimates, to understanding the ripple effects of stakeholder governance on earnings transparency and, finally, shedding light on the evolving landscape of audit practices in the age of data and analytics.

Employee Voice, Manager-employee Alliance and Financial Reporting Opacity

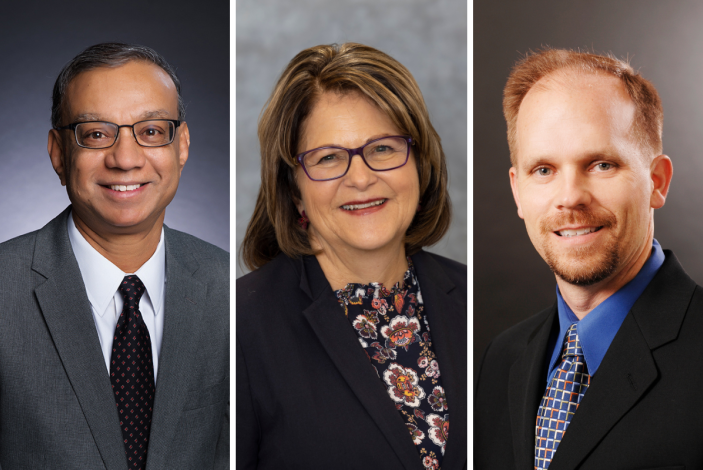

Professor Inder Khurana

In the evolving landscape of stakeholder governance, understanding the dynamics between various stakeholders in a firm becomes pivotal. Professor Inder Khurana's research dives deep into this intricate web, examining the implications of strengthening employee voice in firms and its impact on financial reporting.

Leveraging staggered employment protection laws (EPLs) across 26 countries, Khurana's findings in a coauthored study are striking: managers, when confronted with stronger EPLs, tend to report more opaque earnings. Delving into the underlying mechanisms, the research illustrates how these laws foster a unique manager-employee alliance. This alliance is characterized by reciprocal benefits, in which strengthening employees’ power nudges managers to align with them, leading to mutual benefits. In the wake of such alliances, there is a noticeable uptick in earnings opacity, which diminishes institutional shareholders' monitoring capabilities.

Khurana's study contributes substantially to the accounting literature by being among the first to illuminate how a manager-employee alliance can influence financial reporting behavior. While previously explored in the context of firm acquisitions and restructuring, such alliances are shown in this research to have broader implications, impacting financial reporting at large. This alliance-driven opacity in earnings impedes institutional shareholder oversight and hinders their ability to make timely portfolio adjustments in response to stringent EPLs.

At its core, the study delves into the objectives that managers grapple with while making financial reporting decisions. It underscores the often conflicting interests of shareholders and employees, and how managers navigate these waters. The research suggests that when employees wield significant power to sway managers' private interests, managers may be incentivized to form alliances with employees, using earnings opacity as a shield to conceal joint benefit extractions at the expense of shareholders.

Khurana's findings spotlight the potential pitfalls of the shift from shareholder primacy to a more stakeholder-centric model. It highlights the unintended consequences of robust labor protection laws, which could insulate managers from shareholder scrutiny, compromising financial reporting quality.

The study, “Management-Employee Alliance and Earnings Opacity,” written with Rong (Irene) Zhong, PhD ’15, is published in Contemporary Accounting Research 2023 40(2), 1280-1314. Zhong serves as an assistant professor in the Department of Accounting at the University of Illinois Chicago.

Evaluating the Quality of Data & Analytics in Audit: The Role of Effort Heuristic

Professor Elaine Mauldin

In an age where data-driven approaches are increasingly relevant, auditing is no exception. Professor Elaine Mauldin's study shines a light on the perceptions surrounding the use of data and analytics (D&A) in the auditing process, specifically through the lens of external reviewers.

Mauldin and her co-authors hypothesize that audit firms are tentative in harnessing the full potential of D&A in their procedures, primarily due to uncertainties regarding the evaluations of these approaches by external reviewers. Her experiments reveal that these external reviewers are likely to employ an “effort heuristic” – a cognitive shortcut wherein procedures perceived as less effortful are deemed of lower quality.

Through two meticulously designed experiments, Mauldin and her co-authors deduced that external reviewers perceive D&A audit procedures to be of lesser quality than their traditional counterparts, attributing this disparity to the perceived reduced effort associated with D&A procedures. Interestingly, when provided with a theory-based intervention, the reliance on the effort heuristic by these reviewers was diminished, leading to a more balanced evaluation of both D&A and traditional audit procedures.

Mauldin’s study points to several intriguing avenues for future research. Exploring the influence of individual willingness to adopt technology, understanding how cultural and sociological factors across different countries might affect perceptions and studying potential interventions that can shift these perceptions are just a few of the many directions that future studies could take.

From a public policy perspective, the implications of this study can be profound. It underscores the need for regulators to offer additional training to external reviewers on evaluating D&A-driven audit evidence. Furthermore, given the potential bias against D&A procedures, regulators might need to develop explicit guidance and standards on the quality criteria for evaluating D&A audit approaches.

Her paper, “Auditing with Data and Analytics: External Reviewers' Judgments of Audit Quality and Effort,” is forthcoming in Contemporary Accounting Research.

The Link Between Client Importance and Conservatism in Complex Accounting Estimates

Professor Ken Shaw

Accounting estimates play a central role in accurate financial reports. Some estimates are characterized by high levels of measurement uncertainty and are susceptible to management bias. Even seemingly small adjustments in such estimates can significantly impact reported net income — General Motors increased one year’s pre-tax income by $120 million by using a pension plan discount rate of 6.75% instead of the 6.5% recommended by its auditor.

Professor Ken Shaw's research studies the connection between a client's importance to its local audit office, based on the amount of fees the audit office earns, and the client’s accounting estimate choices.

On one hand, important clients create an economic dependence that could impair auditor independence, and lead to more income-increasing estimates. Alternatively, more important clients impose greater litigation risk and greater reputation loss if the auditor performs a poor audit, leading to more income-decreasing estimates.

Shaw and his co-author, James Whitworth, PhD, ’10, an associate professor at the University of South Florida, examine estimates for stock-based compensation plans and defined-benefit pension plans, complex accounting areas of high audit risk that have attracted scrutiny from regulators like the Public Company Accounting Oversight Board.

The authors find that more important audit clients use conservative accounting estimates, that is, estimates that result in lower net income. These findings suggest that auditor independence remains unscathed with respect to complex accounting estimates for more important clients, aligning with a reputation protection framework. The study also lays the groundwork for further research, potentially exploring the impact of individual audit partners on conservatism and expanding the scope to international settings.

This paper, “Client importance and unconditional conservatism in complex accounting estimates,” is published in Advances in Accounting, September 2022.