Trulaske finance faculty make waves with innovative research

Faculty in the Trulaske College of Business' Finance Department have been hard at work conducting research that sheds light on some of the most pressing issues in the world of finance. In their latest studies, they explore how holidays and sleep affect financial decision-making, the importance of expertise and networks in endowment investing, how exchange listing can improve corporate governance and the role nonbanks play in improving mortgage service quality. In this article, we'll take a closer look at each study and the valuable insights they provide for finance professionals and the global business world.

How Holidays and Sleep Affect Financial Decision-Making

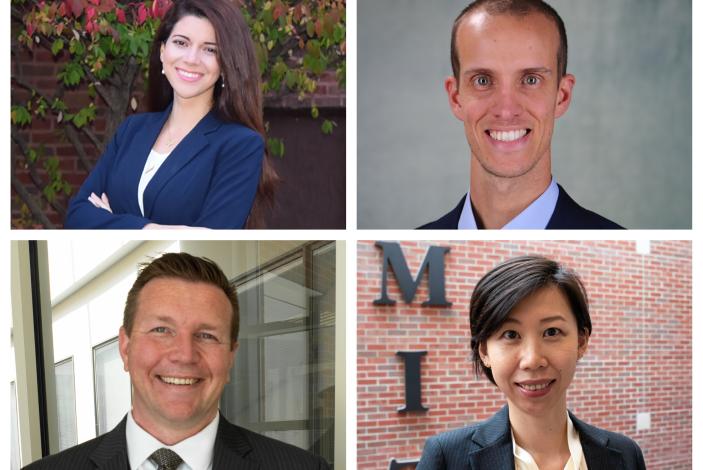

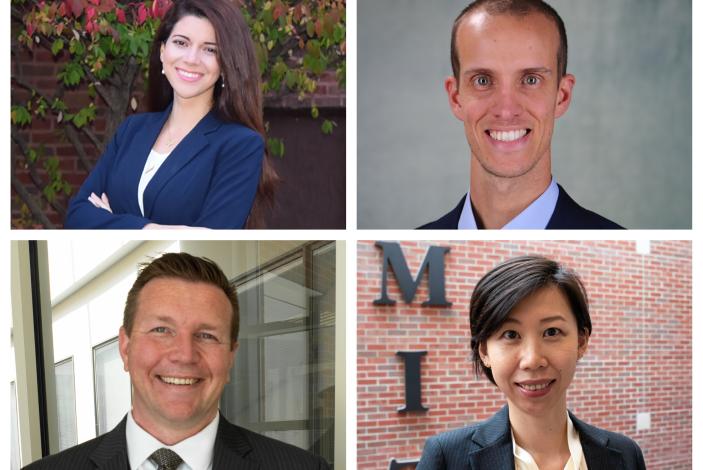

Assistant Professor Sima Jannati's research interest is in the field of behavioral finance, and her latest research explores the impact of rest on financial decision-making. In her working paper, Jannati investigates whether increased rest during holidays improves the judgment and decision-making of equity analysts. Using quarterly earnings forecasts of sell-side analysts, she found that analysts' forecasts issued after paid national holidays are more accurate than those issued before.

“In the financial industry, equity analysts have a reputation for working a lot of hours, an average of 100 a week,” Jannati said. “If our study shows a meaningful impact on the quality of the decisions being made after a short-term break from their work, that could have policy implications regarding whether the traditional 40-hour work week is truly optimal.”

Jannati also explore the role of improved rest time in driving the holiday effect. Using analyst location as a proxy for their average bedtime, Jannati found that the improvement in analyst forecast accuracy around holidays appears to be driven by an increase in sleep, and not necessarily from zoning out before the holiday.

Finally, Jannati explored the market reaction to forecast revisions after a break. Her results show that the post-holiday upward forecast positively increases the total amount of investment gains that exceed the expected return over a certain period of time.

Jannati's findings highlight the importance of taking breaks, particularly for those in high-pressure jobs where good decision-making is essential. It is especially relevant to financial institutions, where decisions can have significant financial consequences.

“Most of my papers are focused on equity analysts because they are very important financial intermediaries,” Jannati explained. “The forecasts and stock recommendations they produce are not only consumed by retail investors like us, but also by institutional investors such as mutual fund and hedge fund managers. These outputs have a significant impact on asset prices."

Jannati presented her paper, “A Ruffled Mind Makes a Restless Forecast: Rest and Financial Judgments,” at an academic conference with the Academy of Behavioral Finance & Economics.

The Role of Expertise and Networks in Endowment Investing

Matteo Binfarè, assistant finance professor, recently researched the link between human capital and endowment investing. Using detailed information on university endowments, Binfarè found that higher asset allocations to alternative assets are linked to higher levels of human capital in the endowment's investment process.

"My research focuses on large institutional investors like endowments, foundations and pension funds,” Binfarè said. “Specifically, I'm studying their investments in alternative assets and how the human capital within their governance, such as the expertise of the team and their network, affects allocation models and performance.”

In this study, Binfarè’s measures of human capital included expertise in alternatives on governing bodies, the presence of a chief investment officer and the size of the investment staff. He found that high levels of human capital are associated with larger returns, even on a risk-adjusted basis. The improved investment outcomes were due to endowments capturing higher returns that can accompany alternative assets, having access to high-performing managers and minimizing fees by accessing funds directly rather than through funds of funds.

Binfarè conducted a novel survey of endowments and confirmed that human capital plays a central role in facilitating alternative investments. The study found that university endowments with more expertise in alternative assets have higher allocations to these assets. These effects are concentrated in alternative assets such as venture capital, private equity and hedge funds, with many endowments having large allocations.

The study also found that having a chief investment officer is positively linked to private equity and venture capital allocations, which involve complexities such as managing capital calls and dealing with illiquidity. These findings suggest that some elements of expertise are unique to the type of investment and have broad implications for forming governing bodies and creating staff capabilities for endowments.

Overall, the study shows that endowments directly benefit from having experts in alternative assets serving on boards and from more specialized skills within endowment investment teams. The potential benefits seem highest in areas such as private equity and venture capital.

The research has implications for institutional investors beyond university endowments, highlighting the importance of human capital in investment management and the potential benefits of expertise and networks in alternative assets. The study suggests that investors with access to these assets may benefit from forming governing bodies and creating staff capabilities with specialized expertise.

Published in Review of Finance, the paper, “How Does Human Capital Affect Investing? Evidence from University Endowments,” received the 2019 Two Sigma Award for Best Paper on Investment Management.

Exchange Listing Improves Corporate Governance

Exchange listing can improve the quality of corporate governance, according to the research of Adam Yore, an associate finance professor and Stephen Furbacher Professor of Organizational Change. In his study co-authored with Andrew Kern (University of Missouri), Dan French (Lamar University), and Thibaut Morillon (Elon University), Yore analyzed the impact of exchange membership on public nonlisted real estate investment trusts (PNLRs) and their corporate governance.

Yore's study found that younger, more profitable PNLRs with stronger governance and professional management are more likely to directly list. This may assuage some fears that direct listing without the certification of a Wall Street investment bank introduces lower quality firms into the public markets. After listing, institutional ownership increases and internal corporate governance improves beyond the exchange's requirements, especially for those companies with greater stock liquidity and more institutional ownership.

Corporate governance refers to a company's rules, processes and practices to control and manage its operations. Good corporate governance helps ensure that companies are run effectively, ethically and with the interests of shareholders and other stakeholders in mind.

Exchange listing legally and reputationally bonds the company to higher corporate governance standards, which reassures investors that they will not face future expropriation. Yore's research found that firms directly listing on an exchange are indeed better governed and of higher quality than their counterparts that do not list.

The research also found that governance quality improves after joining an exchange and does so outside exchange requirements. After their listing, firms attract more independent and possibly more experienced directors. Almost every firm discloses executive compensation information, which shows director and CEO compensation doubling post-listing while the founders hand over control to professional managers.

Yore's research should come as reassurance to investors concerned that direct listing on a stock exchange, outside the traditional IPO process, is risky or invites the exploitation of unsophisticated investors. Instead, exchange listing can improve the quality of corporate governance and help ensure that companies are run more effectively and ethically. Yore's research can help to encourage more companies to list on an exchange, which can, in turn, help to improve the quality of the public market and provide investors with greater confidence in the companies they invest in.

The paper, “The Impact of Exchange Listing on Corporate Governance: Evidence from Direct Listing,” is currently forthcoming in The Financial Review.

How Nonbanks Improve Mortgage Service Quality

Assistant Professor and Thomas H. Weaver Faculty Scholar Jing Wang's research focuses on the consequences of the rise of nonbanks on the service quality in the residential mortgage market. Nonbanks are financial institutions that do not hold a banking license but provide financial services, such as mortgage lending.

Wang found that as nonbanks increase their market share in a local residential mortgage market, the quality of mortgage services improves. She conducted two instrumental variable analyses to confirm this finding, which exploited stress tests conducted by the Federal Reserve and variations in state-level mortgage surety bonds.

“We found that as nonbanks grow their market share, they develop a specialty in servicing lower-income borrowers and increase investment in technology, leading to improved service quality. This improvement in service quality is more pronounced in counties with a higher percentage of minority populations,” Wang said.

The specific aspect of service quality that the research focuses on is the mortgage-related complaints filed with the Consumer Financial Protection Bureau (CFPB) as a percentage of all outstanding mortgages, known as the complaint ratio. As nonbanks increase their market share in a county, the complaint ratio of the county decreases.

"Measuring financial service quality can be tricky because it's subjective. To overcome this, we took advantage of the CFPB website, which allows people to file complaints if they're having issues with financial institutions. The CFPB collects this data and publishes it on their website, so we used it as a way to evaluate service quality,” Wang said. “This angle gave us insight into customers' personal experiences, as they file complaints about difficulties communicating or getting issues resolved with financial institutions. It's an innovative way to measure service quality, and it helped us gain a different perspective."

Even though nonbanks have a higher complaint ratio than traditional banks on average, the research found that nonbanks significantly improve their service quality as their market share increases, contributing to reducing the complaint ratio at the county level.

Wang's research is the first to focus on the service quality of mortgages to understand the consequences of nonbanks' expansion on consumer welfare. The findings suggest that future policies and regulations of nonbanks should consider the effect of market shares on service quality. Wang's findings echo previous research in that the nontraditional part of the financial sector has the potential to improve the efficiency of the financial system.

Wang is currently working on a paper in this area: “The Rise of Nonbanks and the Quality of Financial Services”.